The Fed don't play that

Smoke Signal - Issue # 10

Liquidity is King

Liquidity is a prerequisite to solvency. You can hide (in)solvency if you have access to liquidity; however if you are insufficiently liquid when it counts, you will not maintain solvency.

Silvergate (SI) and Silicon Valley Bank (SIVB) were reminded of this in the most brutal of fashions last week as both collapsed, leaving billions of dollars in uninsured deposits hanging in the balance. Hello again 2008 … sort of.

While both banks could have done a better job of hedging risk, managing duration risk and customer deposit growth rates, it is important to note they were both solvent. However, customer requests for redemptions exceeded their liquidity - the ability to access immediate cash - and the inability to do so quickly led to insolvency.

Matt Levine’s piece is a good overview of last week’s events. And if you are interested in kicking a dead horse, this thread does a particularly good job of exposing a number of questionable practices at SIVB.

My short essay is not about the potential mismanagement at SI or SIVB - surely fault can be found at either bank. Instead my thoughts are focusing on the accomplice to the murder of SI and SIVB: The Fed.

Keep in mind that SI had an enterprise value smaller than its equity value, which means it held more cash than debt on its balance sheet. Despite banking “crypto companies” SI was not holding toxic assets, although the events of last week increasingly support a position that long-term treasuries are indeed poisonous.

Also keep in mind that both SI (the “crypto bank”) and SIVB (the “venture capital bank”) were regulated directly by the Fed. This means the Fed had full knowledge of the increasing illiquidity of both banks leading up to their failures, at least in relation to the number of long-dated Treasury bonds both banks held.

Let me repeat, they had full visibility as they were the direct overseer. An equivalent scenario would be a Board of Directors that monitors and approves monthly daily financials only to suddenly condemn and execute the performers when it suits a need - to send a message perhaps? But who is the message meant for: the crypto bros 🤔, the tech bros 🤔, China 🤔? Did the Fed expect financial contagion? Did they purposely initiate financial contagion? Did they think these actions could result in anything but financial contagion? We will find out tomorrow!

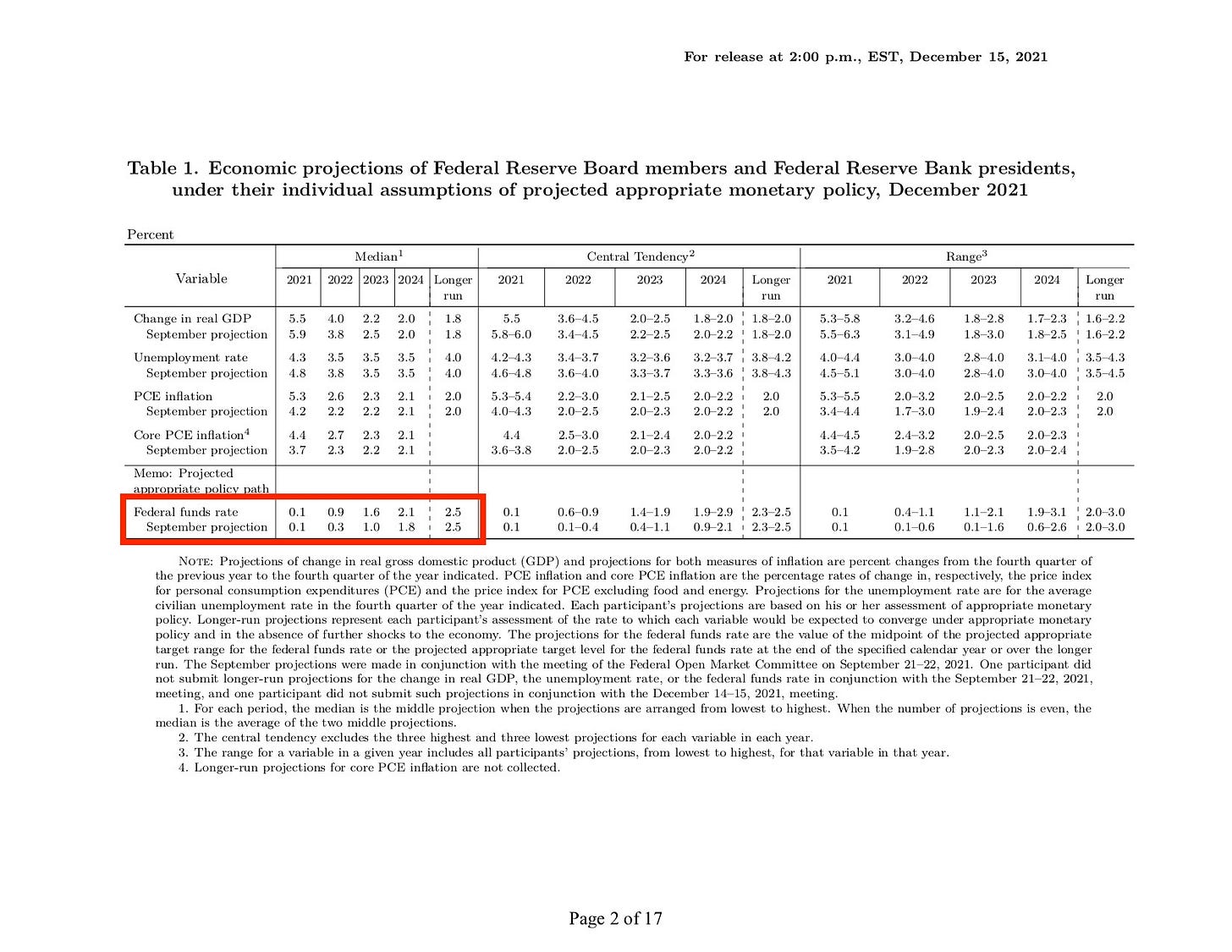

In December 2021, the Fed Funds Rate was 0.08%. In that same month the Fed projected that nine months later in September 2022 the rate would increase to 0.30%. Instead, by last September the rate jumped to 2.56% - they mis-projected (or lied) by a factor of 8.5x. Keep in mind that the price of money is the pre-eminent input assumption; the forecaster is also the price-setter.

That same forecasting exercise projected September 2023 rates at 1.0%. Yet today the rate is 4.75%, equating to a 60x increase in the price of money since December 2021.

If you are interested in a more detailed dive into how the Fed manages monetary policy I can recommend the insightful if not harrowing Lords of Easy Money by Christopher Leonard. And if you are more of a (dystopian) fiction person then please please dive into The Mandibles by Lionel Shriver.

Two things can be right at the same time. While valid arguments can be made about mismanagement and greed at banks, it is still true that the forecaster of the price of money (the Fed) is an extremely poor forecaster of its own prices.

This poor forecasting is partly responsible for the demise of SI and SIVB and fully responsible for the financial contagion that will plague us for the rest of this year and beyond.

Banks distribute and multiply money that the Fed creates. Both SI and SIVB did this for the Fed. They were Federal Reserve Member Banks (unlike Lehman Brothers) - meaning they qualified for emergency loans if in the possession of “adequate collateral”. Both held long-dated Treasuries - aka “future money”. If such money is not adequate it begs the question: what is?

If we think of the Fed as the Mafia Boss, then SI and SIVB were two of its Capos. Last week the Boss decided that SI and SIVB had to be fed to the fishes. The Boss had to remind constituents it has absolute power. Draconian moves correlate with mistakes, oversight and overreach. If the Boss wields too small of a stick the Capos may become lazy, but if the stick is too big the Capos and everyone else loses faith in the Boss and chaos ensues. Are we there yet?

The Fed attacked crypto and tech by facilitating the demise of SI and SIVB. These banks were forced to sell future money (allegedly) backed by the US government at a loss because the Fed either miscalculated the potential for contagion or wanted to create contagion by design.

Remember that by doing this the Fed is making it clear that they themselves value today’s money more than their own future money, despite them creating both monies with a stroke of the pen. By forcing these banks to sell future money (US government debt) and also disregarding it as adequate collateral amidst a liquidity crunch the Fed is penalizing these banks for following its own historic guidance - remember just 15 months ago they said that the Fed Funds Rate was supposed to be between 1.0 - 1.6% today.

To recap, in December 2021 the Fed Funds Rate was 0.08% and the yield on the 10-year Treasury hovered around 1.5%. If a bank decided to pursue a non-traditional business model and invest 100% of deposits in fully liquid securities it could not be profitable with a Fed Funds Rate of 0.08%. Investing in long-dated Treasuries at 1.5% is hardly an aggressive investment decision - in fact it is one that does not even keep pace with inflation. These banks did not convert deposits into FTT, they invested in the Government! In short, they trusted the Fed to honor the money it created for these banks to distribute and multiply, but ultimately the Fed broke the promise.

Banks are the recipients of the cash injected into the economy when the Federal Reserve increases its balance sheet. The Fed relies on banks to move around and multiply / (diversify) the concentration of money. It is called the money multiplier effect and it is how the fractional reserve banking system works. By letting these specific banks fail the Fed has sent a strong signal that it holds absolute power not only over the money but also to whom it does and does not want it freely distributed.

Update: I’m a slow / novice writer (and Dad to a 3 year old) so this post has been written in fits and starts over the last three days. As a result it is already slightly out of date because just two hours ago the Fed announced it will 100% back all depositors impacted by the demise of SI and SIVB. Additionally, it announced that it was murdering “the other crypto bank” - Signature Bank (SBNY) as of today.

This is an unprecedented situation (at least in my lifetime). Three solvent banks (as of last Sunday) forced into insolvency by the Fed within days of each other.

Some important acronyms in the news this week:

AFS - Available for Sale (short-term government money held by a bank that is marked to market. Banks can sell these at or close to par value if they need to do so. In other words these are liquid holdings.)

HTM - Held to Maturity (long-term government money that is not marked to market, which is another way of saying it is held on the bank’s balance sheet as an unrealized loss or gain until maturity. However, if the bank needs to sell such securities before maturity then they will have to do so at a loss if interest rates have risen since they were purchased.)

GSIB - Global Systemically Important Bank (there are 8 such banks based in the US and an additional 22 across the world. The US-based “too big to fail” banks are: Bank of America Corporation, The Bank of New York Mellon Corporation, Citigroup Inc., The Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley, State Street Corporation and Wells Fargo & Company)

Song of the week - Boa Sorte / Good Luck by Vanessa Da Mata ft. Ben Harper

Wishing good luck and good vibes to all market participants tomorrow!

To me, it seems like this is a critique of the federal reserve system to a large extent. But one thing I don't think thats covered in depth is bank regulation and capital requirements that require them to hold capital (and certain types of capital) in proportion to their deposits. This becomes relevant when banks have losses for one reason or the other. It’s not just about duration risk. Its about matching your assets with your liabilities as a bank and when it goes wrong it can be catastrophic when capital is inadequate. What SVB management did was take on alot of (duration) risk to juice quarterly earnings as it could not deploy the rush of startup deposits gained in recent years into loans. Investing in treasuries was probably because mgmt thought interest rates would remain low, and probably also why they didn't swap from fixed rate to floating rate to minimise rate exposure. The Fed then raised rates at a very rapid pace causing long duration assets to plummet (its pure math why this occurs) and hence the need for SVB to raise capital given the value of treasuries declined. The treasuries declined in value since repayment was so far away (they would still get repaid at par in 10yrs) but the present value of those cash flows changed because discount rates are higher now because if rate increases. SVB had to plug this paper loss by raising more equity in order to have enough regulatory capital and this obviously set off an alarm among a concentrated depositor base that was less sticky than retail deposits which wanted to pull their money causing the run. In essence, it wasn't just one factor that led to SVB’s demise. This was a tinderbox waiting for a rate driven match.

I guess you can criticise the Fed for the pace of rate increases but their mandate is price stability (ie low inflation) and this exercised through rate setting and their operations in the banking sector. Price stability is driven by data. And the thousands of data points the Fed uses forms their view for what rates should be. Now granted the initial Fed view was inflation was transitory was based on available data but the effects of covid -19, labour shocks, supply chain issues and finally war in Ukraine in addition to other things weren't completely obvious in the data, hence the need for aggressive tightening.

This is probably a convo for in person tbh! We have had over 10 years

of almost zero interest rates. The adjustment to what is a normal environment will take some time and is an ongoing process. This is just one casualty to the return to normal, in my view.